Of course, it comes with eligibility requirements...

more here

Consolidate Student Loans Guide

Saturday, September 13, 2008

Friday, March 10, 2006

US Dept. Of Educations "Katrina Specific" Help Website

The Dept. Of Education has set up a website specifically for those affected Hurricane Katrina.

Some of the topics are:

How to Get Help

Donate and Volunteer

Finding Friends and Information

Health and Safety

Hurricane Contracting Information Center

White House Hurricane Relief

Additional Resources

Some of the topics are:

How to Get Help

Donate and Volunteer

Finding Friends and Information

Health and Safety

Hurricane Contracting Information Center

White House Hurricane Relief

Additional Resources

Thursday, March 09, 2006

Interest Rate Increase Closing In

Thinking about consolidating your student loan debt? You have until June 30, 2006, before new interest rates kick in. However, if you are a new graduate, you'll want to weigh the pros and cons of consolidation loans fairly quickly. After graduation, you have a six-month grace period before the loan payments begin. By consolidating during the grace period, you save about one-half a percentage point. A summer 2005 graduate could lock in a 4.7 percent rate on Stafford loans, rather than the 5.3 percent rate that kicks in at the start of the repayment period.

The only drawback to consolidating during your grace period is you'll need to start making payments immediately. Not ready to give up those blissful, payment-free months? You could keep much of your grace period by waiting to consolidate until the last month of the grace period..

With a federal consolidation loan, your lender pays off the balances of all the loans you choose to consolidate and then issues you a new loan. Keep in mind though that once you consolidate your loans, there's no going back.

"Once you consolidate there is no way to un-consolidate," says Patricia Scherschel, vice president of loan consolidation at Sallie Mae. "Consolidation is a one-way street."

The interest rate on a consolidation loan is determined by taking the weighted average of interest rates on the federal education loans the student has and rounding up to the nearest one-eighth of a percentage point, capped at 8.25 percent. The final rate will differ from student to student.

Many borrowers sign on for a consolidation loan because they need more breathing room in their monthly budgets. A consolidation loan can lower a borrower's monthly loan payment by as much as 40 percent while stretching out the repayment period.

If your student loan payments add up to more than 8 percent of your gross monthly salary, you're a good candidate for a consolidation loan.

And you don't need multiple loans to enjoy the benefits of a consolidation loan. If your loan amount is high enough, typically $7,500 or more, you may be able to consolidate a single loan. Even though the initial interest rate on that loan won't change much, it will lock in these lower rates for the life of the loan.

The only drawback to consolidating during your grace period is you'll need to start making payments immediately. Not ready to give up those blissful, payment-free months? You could keep much of your grace period by waiting to consolidate until the last month of the grace period..

With a federal consolidation loan, your lender pays off the balances of all the loans you choose to consolidate and then issues you a new loan. Keep in mind though that once you consolidate your loans, there's no going back.

"Once you consolidate there is no way to un-consolidate," says Patricia Scherschel, vice president of loan consolidation at Sallie Mae. "Consolidation is a one-way street."

The interest rate on a consolidation loan is determined by taking the weighted average of interest rates on the federal education loans the student has and rounding up to the nearest one-eighth of a percentage point, capped at 8.25 percent. The final rate will differ from student to student.

Many borrowers sign on for a consolidation loan because they need more breathing room in their monthly budgets. A consolidation loan can lower a borrower's monthly loan payment by as much as 40 percent while stretching out the repayment period.

If your student loan payments add up to more than 8 percent of your gross monthly salary, you're a good candidate for a consolidation loan.

And you don't need multiple loans to enjoy the benefits of a consolidation loan. If your loan amount is high enough, typically $7,500 or more, you may be able to consolidate a single loan. Even though the initial interest rate on that loan won't change much, it will lock in these lower rates for the life of the loan.

Wednesday, March 08, 2006

Forbearance Issues

I received this email from Cody of Houston, TX recently regarding his student loan:

"Manny - found your blog. I want to know if others are having the same problems with the Direct Loan Servicing Federal Student Aid program.

I live in Houston where I had a few leaves blown off my tree by Rita. The government automatically deferred my student loan payments without my consent. I accrued two months of interest on my balance amounting to about $200. Upon the restart of my payments, my monthly payment went up by $7/month with 72 months to go. Cumulatively, this would amount to roughly $510 of payments on $200 of accrued interest though my interest rate had not changed from the 4 5/8% it was previously. When I raised this red flag to the DLS, they stated that my loan had been miscalculated from the get-go and this was the new payment.

I called B.S. and have requested paperwork on the loan recalculation be sent to me in writing.

Please let me know if you hear of other cases."

Thanks for sharing your experience Cody. Mandatory forbearance (automatically granting forbearance) is not unheard of in times of disaster. But I was under the impression that one still had to request it, or at least sign some kind of written agreement. The whole thing sounds like a big mistake to me, but I think you did the right thing by requesting proof of their claims.

Please keep me updated, I would like to know how everything turns out.

Manny

"Manny - found your blog. I want to know if others are having the same problems with the Direct Loan Servicing Federal Student Aid program.

I live in Houston where I had a few leaves blown off my tree by Rita. The government automatically deferred my student loan payments without my consent. I accrued two months of interest on my balance amounting to about $200. Upon the restart of my payments, my monthly payment went up by $7/month with 72 months to go. Cumulatively, this would amount to roughly $510 of payments on $200 of accrued interest though my interest rate had not changed from the 4 5/8% it was previously. When I raised this red flag to the DLS, they stated that my loan had been miscalculated from the get-go and this was the new payment.

I called B.S. and have requested paperwork on the loan recalculation be sent to me in writing.

Please let me know if you hear of other cases."

Thanks for sharing your experience Cody. Mandatory forbearance (automatically granting forbearance) is not unheard of in times of disaster. But I was under the impression that one still had to request it, or at least sign some kind of written agreement. The whole thing sounds like a big mistake to me, but I think you did the right thing by requesting proof of their claims.

Please keep me updated, I would like to know how everything turns out.

Manny

Tuesday, March 07, 2006

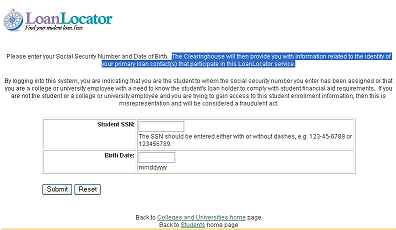

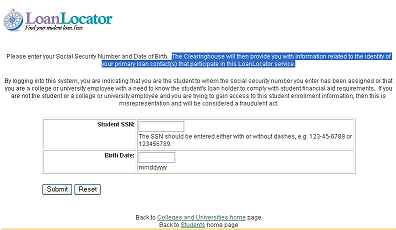

Where Are My Student Loans?

Can't remember where you got your loan? Use this Loan Locator.

All you need is your Social Security No. and your date of birth to get the info for your primary loan contact.

All you need is your Social Security No. and your date of birth to get the info for your primary loan contact.

Monday, March 06, 2006

Going Back To School

It is now easy to restore your eligibility to receive additional Title IV federal financial aid. Basically, your options are:

Since defaulted student loans have no statute of limitations for enforceability, you would remain ineligible for additional federal financial aid until you complete one of the options mentioned above.

Repay or satisfy the loan in full.

Make six agreed-upon monthly payments over a six month period. Your payment amount must be approved in advance by the Department. Every qualifying payment must be timely (received before the due date) and you cannot make all six payments as a single lump sum payment. Once your eligibility to receive additional federal financial aid has been restored after making six consecutive monthly payments, you must continue to make timely monthly payments to maintain your eligibility or else it will be permanently lost until the debt is resolved entirely. In other words, you may qualify for this program only once.

Consolidate your loan through the FFEL loan consolidation program or the William D. Ford Direct Loan Program.

Rehabilitate your loan through the FSA loan rehabilitation program.

Since defaulted student loans have no statute of limitations for enforceability, you would remain ineligible for additional federal financial aid until you complete one of the options mentioned above.

Sunday, March 05, 2006

Defaulted Student Loans

If you default on your student loan, the maturity date of each promissory note is accelerated making payment in full immediately due, and you are no longer eligible for any type of deferment or forbearance. Continued failure to repay a loan in default may lead to several negative consequences for you over the long-term including having your wages garnished, your Federal income tax withheld, and losing your eligibility for other federal loans like FHA or VA.

However, there are now more ways than ever before to repay your defaulted student loan and certain programs even can even remove your loan from its defaulted status. Determining which repayment option that is right for you depends on what your objective is.

All guaranty agencies and the U.S. Department of Education (ED) will accept regular monthly payments that are both reasonable to the agency and affordable to you. You should call 1-800-621-3115 (US Dept. Of Education)and one of customer service representatives will assist you with determining a repayment amount that is right for you.

Please see Going Back to School for more information on this topic.

Your options for reinstating your eligibility to receive a HUD (FHA) or VA loan are: repay or satisfy the loan in full; consolidate your loan through the FFEL loan consolidation program or the William D. Ford Direct Loan Program; or rehabilitate your loan through our loan rehabilitation program. Since defaulted student loans have no statute of limitations for enforceability, you would remain ineligible to receive a HUD or VA loan until you complete one of the options mentioned above.

If you want all negative credit reports made by the Department to your credit record, you must successfully complete the loan rehabilitation program.

Absolutely. They accept American Express, Discover, Master Card and Visa as repayment options. To repay a loan by credit card, please call the Department of Education at 1-800-621-3115.

What address do I send my payments to?

If you have a defaulted student loan held by the Department of Education, you can mail a check or money order to the address below. If you are at all unsure about the status of your loan, or who currently holds your loan, please call first at 1-800-621-3115 before sending in payment. You may also use Loan Locator to help you find out what lenders currently hold your loan(s).

National Payment Center

P.O. Box 4169

Greenville, TX 75403-4169

However, there are now more ways than ever before to repay your defaulted student loan and certain programs even can even remove your loan from its defaulted status. Determining which repayment option that is right for you depends on what your objective is.

"I want to pay my defaulted student loan in monthly payments that are affordable to me."

All guaranty agencies and the U.S. Department of Education (ED) will accept regular monthly payments that are both reasonable to the agency and affordable to you. You should call 1-800-621-3115 (US Dept. Of Education)and one of customer service representatives will assist you with determining a repayment amount that is right for you.

"I want to reestablish my eligibility for additional federal financial aid and go back to school."

Please see Going Back to School for more information on this topic.

"I'm applying for a HUD (FHA) or VA loan and I don't qualify because of my defaulted student loan."

Your options for reinstating your eligibility to receive a HUD (FHA) or VA loan are: repay or satisfy the loan in full; consolidate your loan through the FFEL loan consolidation program or the William D. Ford Direct Loan Program; or rehabilitate your loan through our loan rehabilitation program. Since defaulted student loans have no statute of limitations for enforceability, you would remain ineligible to receive a HUD or VA loan until you complete one of the options mentioned above.

"My credit record is tarnished because of my defaulted student loan. Is there anything that I can do to improve my credit record?"Failure to repay your defaulted student loan can be damaging to your credit record. In fact, consumer reporting agencies may continue to report an account for 7 years from the opening date. However, there are several things that you can do to at least partially, and in some cases, fully restore your credit record. Your options for bettering your credit report include: repay or satisfy the loan in full; consolidate your loan through the FFEL loan consolidation program or the William D. Ford Direct Loan Program; or rehabilitate your loan through the FSA loan rehabilitation program.

If you want all negative credit reports made by the Department to your credit record, you must successfully complete the loan rehabilitation program.

"Can I pay my defaulted student loan held by the Department by credit card?"

Absolutely. They accept American Express, Discover, Master Card and Visa as repayment options. To repay a loan by credit card, please call the Department of Education at 1-800-621-3115.

What address do I send my payments to?

If you have a defaulted student loan held by the Department of Education, you can mail a check or money order to the address below. If you are at all unsure about the status of your loan, or who currently holds your loan, please call first at 1-800-621-3115 before sending in payment. You may also use Loan Locator to help you find out what lenders currently hold your loan(s).

National Payment Center

P.O. Box 4169

Greenville, TX 75403-4169

Thursday, March 02, 2006

Federal Student Financial Aid Deadlines

The 2005-2006 School Year (July 1st, 2005 - June 30th, 2006):

FAFSA on the Web, Renewal FAFSA on the Web, and applications must be submitted by midnight Central Daylight time, June 30, 2006.

Corrections on the Web forms must be submitted by midnight Central Daylight time, September 15, 2006.

The 2006-2007 School Year (July 1st, 2006 - June 30th, 2007):

FAFSA on the Web, Renewal FAFSA on the Web, and applications must be submitted by midnight Central Daylight time, July 2, 2007.

Corrections on the Web forms must be submitted by midnight Central Daylight time, September 17, 2007.

More

FAFSA on the Web, Renewal FAFSA on the Web, and applications must be submitted by midnight Central Daylight time, June 30, 2006.

Corrections on the Web forms must be submitted by midnight Central Daylight time, September 15, 2006.

The 2006-2007 School Year (July 1st, 2006 - June 30th, 2007):

FAFSA on the Web, Renewal FAFSA on the Web, and applications must be submitted by midnight Central Daylight time, July 2, 2007.

Corrections on the Web forms must be submitted by midnight Central Daylight time, September 17, 2007.

More

Wednesday, March 01, 2006

Deferment, forebearance and other temporary relief

If you have trouble making your education loan payments, contact immediately the organization that services your loan. You might qualify for a deferment, forbearance, or other form of payment relief. It's important to take action before you are charged late fees. For Federal Perkins Loans, contact your loan servicer or the school that made you the loan. For FFEL Loans, contact the lender or agency that holds your loan. For Direct Loans, contact the Direct Loan Servicing Center at www.dl.ed.gov or by calling 1-800-848-0979 or 1-315-738-6634. TTY users should call 1-800-848-0983.

Deferment: You can receive a deferment for certain defined periods. A deferment is a temporary suspension of loan payments for specific situations such as reenrollment in school, unemployment, or economic hardship. For a list of deferments, click here. You don’t have to pay interest on the loan during deferment if you have a subsidized FFEL or Direct Stafford Loan or a Federal Perkins Loan. If you have an unsubsidized FFEL or Direct Stafford Loan, you’re responsible for the interest during deferment. If you don’t pay the interest as it accrues (accumulates), it will be capitalized (added to the loan principal), and the amount you have to pay in the future will be higher. You have to apply for a deferment to your loan servicer (the organization that handles your loan), and you must continue to make payments until you’ve been notified your deferment has been granted. Otherwise, you could become delinquent or go into default.

Forbearance: Forbearance is a temporary postponement or reduction of payments for a period of time because you are experiencing financial difficulty. You can receive forbearance if you’re not eligible for a deferment. Unlike deferment, whether your loans are subsidized or unsubsidized, interest accrues, and you’re responsible for repaying it. Your loan holder can grant forbearance in intervals of up to 12 months at a time for up to 3 years. You have to apply to your loan servicer for forbearance, and you must continue to make payments until you've been notified your forbearance has been granted.

Note to PLUS Loan borrowers: Generally, the same eligibility requirements and procedures for requesting a deferment or forbearance that apply to Stafford Loan borrowers also apply to you. However, since all PLUS Loans are unsubsidized, you'll be charged interest during periods of deferment or forbearance. If you don't pay the interest as it accrues, it will be capitalized (added to the principal balance of the loan), thereby increasing the amount you'll have to repay.

Other forms of payment relief: Graduated and income-sensitive repayment plans are available. Graduated payment plans provide short-term relief through low interest-only payments followed by a gradual increase in payments (usually every two years). An income-sensitive payment plan offers borrowers payments based on yearly income. As that rises and falls, so do the payments.

Deferment: You can receive a deferment for certain defined periods. A deferment is a temporary suspension of loan payments for specific situations such as reenrollment in school, unemployment, or economic hardship. For a list of deferments, click here. You don’t have to pay interest on the loan during deferment if you have a subsidized FFEL or Direct Stafford Loan or a Federal Perkins Loan. If you have an unsubsidized FFEL or Direct Stafford Loan, you’re responsible for the interest during deferment. If you don’t pay the interest as it accrues (accumulates), it will be capitalized (added to the loan principal), and the amount you have to pay in the future will be higher. You have to apply for a deferment to your loan servicer (the organization that handles your loan), and you must continue to make payments until you’ve been notified your deferment has been granted. Otherwise, you could become delinquent or go into default.

Forbearance: Forbearance is a temporary postponement or reduction of payments for a period of time because you are experiencing financial difficulty. You can receive forbearance if you’re not eligible for a deferment. Unlike deferment, whether your loans are subsidized or unsubsidized, interest accrues, and you’re responsible for repaying it. Your loan holder can grant forbearance in intervals of up to 12 months at a time for up to 3 years. You have to apply to your loan servicer for forbearance, and you must continue to make payments until you've been notified your forbearance has been granted.

Note to PLUS Loan borrowers: Generally, the same eligibility requirements and procedures for requesting a deferment or forbearance that apply to Stafford Loan borrowers also apply to you. However, since all PLUS Loans are unsubsidized, you'll be charged interest during periods of deferment or forbearance. If you don't pay the interest as it accrues, it will be capitalized (added to the principal balance of the loan), thereby increasing the amount you'll have to repay.

Other forms of payment relief: Graduated and income-sensitive repayment plans are available. Graduated payment plans provide short-term relief through low interest-only payments followed by a gradual increase in payments (usually every two years). An income-sensitive payment plan offers borrowers payments based on yearly income. As that rises and falls, so do the payments.

Tuesday, January 03, 2006

Repaying Your Student Loans Publication

You’ve attended college or received other education beyond high school, and you received federal student loans from the US Department of Education (ED) along the way. You’re now about to deal with paying them back. You’ll need to know how to manage your student loan debt to avoid repayment problems. This publication explains available repayment options so you can successfully repay your debt. It will also tell you what steps to take so you won’t get behind in payments or go into default.

You’ve attended college or received other education beyond high school, and you received federal student loans from the US Department of Education (ED) along the way. You’re now about to deal with paying them back. You’ll need to know how to manage your student loan debt to avoid repayment problems. This publication explains available repayment options so you can successfully repay your debt. It will also tell you what steps to take so you won’t get behind in payments or go into default.Federal student loans are real loans, just like car loans or mortgage loans. You can’t just get out of repaying a student loan if your financial circumstances become difficult, unless you qualify for bankruptcy. But, it’s very difficult to have federal student loans discharged in bankruptcy; this happens only rarely. Also, you can’t cancel your student loans if you didn’t get the education you expected, didn’t get the job you expected, or didn’t complete your education, unless you leave school for a reason that qualifies you for a discharge of your loan. Remember, your student loans belong to you; you have to pay them back.

Available in .pdf format (you will need adobe acrobat reader)

Download English Version

Download Spanish Version

Subscribe to:

Comments (Atom)